The UK stock market is heading lower this morning (3 February) and things don’t look much better across the Atlantic. US tariffs are weighing on share prices virtually across the board.

There are some exceptions, but the sell-off is broader than last week’s decline in artificial intelligence (AI) stocks. So what should investors do?

Is it actually that bad?

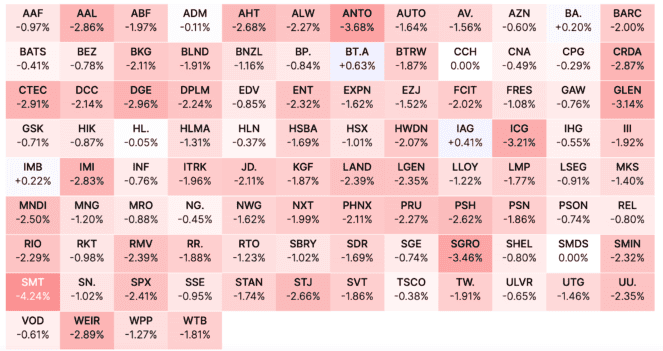

A quick look at the FTSE 100 this morning indicates share prices are heading lower across the board. And while there are a few outliers either side, the median stock seems to be down around 2%.

Should you invest £1,000 in Diploma Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diploma Plc made the list?

FTSE 100 heatmap 3 February 2025

Source: Hargreaves Lansdown

First things first – investors need to keep this one in context. For example, Diploma (LSE:DPLM) shares have fallen almost 3%, but they’re still trading above where they were a week ago.

Sudden movements in stock prices can make ups and downs feel more dramatic than they are. When a stock climbs or falls steadily for five days, it can be hard to notice, compared to a similar-sized jump or fall in a day.

That’s not to say stocks can’t fall further from here. They absolutely can, but investors should be careful about overreacting to a decline that might feel bigger than it actually is.

What if it gets worse?

US tariffs are the reason share prices are falling this morning and I wouldn’t like to forecast what the outcome will be. It might cause inflation, currency fluctuations, neither, or both.

In these situations, I think the best thing to do is to hope for the best and plan for the worst. In terms of the stock market, that means focusing on shares in quality companies.

If things get worse, the best businesses are the ones that are the most likely to prove resilient. And if they get better, the strongest operations should be able to find ways to take advantage.

With share prices falling across the board, I believe that focusing on whatever they think the highest quality companies are gives investors the best chance of doing well over the long term. That’s what I’m doing.

Diploma

Diploma is a distributor of industrial components. The risk of sales faltering in a weak manufacturing environment is one to take seriously, but there’s a lot to like about the way the business is set up.

The company attempts to distinguish itself from other distribution businesses by adding value for customers. One of the ways it does this is by holding a huge inventory.

This is convenient for customers, who know they won’t have to go looking around when they need something in a hurry. And the company’s scale means it can get parts delivered quickly and reliably.

As a result, Diploma is able to maintain strong margins while expanding further through acquisitions. This makes it a very difficult business to disrupt and one I think is worth paying attention to.

What to do?

Seeing shares selling off across the board can look like a huge buying opportunity. But rushing into buying stocks can be dangerous, especially when prices are still higher than they were a week ago.

Diploma is a great illustration of this. The falling share price makes me tempted to jump in, but I’m being careful to keep an eye on the bigger picture at the moment.